QuickBooks Manufacturing Software: 4 Integration Items to Consider

As ERP consultants, we run into examples all the time where QuickBooks is not an ideal solution for manufacturing for customers using QuickBooks out...

3 min read

Jerie Harrell Wed, Mar 19, 2014

As QuickBooks consultants, we appreciate and our customers appreciate the flexibility and ease of use of QuickBooks. For example, there’s more than one way to record a payment in QuickBooks depending on the situation. Now let’s face it, there are undoubtedly some QuickBooks tasks that are more enjoyable than others. It’s no fun paying bills and making collection calls on unpaid invoices can be downright unpleasant.

You probably don’t mind recording payments after all of your hard work creating products or providing services, sending invoices or statements, and generating reports to make sure you’re on top of it all.

QuickBooks offers more than one way to document customer remittances, and it’s important that you use the right one for the right situation.

1. Defining the destination

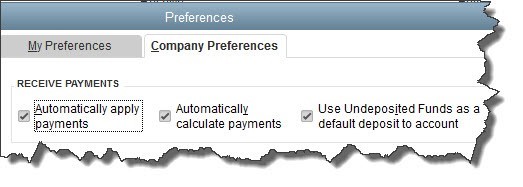

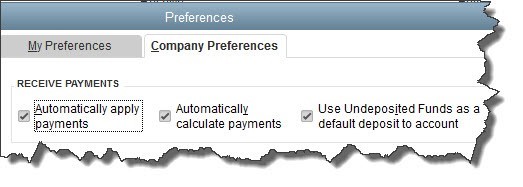

Figure 1: Uncheck the box on the farthest right if you think you may want to direct payments to other accounts sometimes.

Before you begin receiving payments, you need to make sure they’ll end up in the correct account. The default is an account called Undeposited Funds. To make sure that this setting is correct, open the Edit menu and select Preferences, and click the Company Preferences tab. Use Undeposited Funds as a default deposit to account should have a check mark in the box next to it.

If you think you’ll sometimes want to deposit to a different account, leave the box unchecked. Then every time you record a payment, there’ll be a Deposit to field on the form. Talk to us if you’re planning to use any account other than Undeposited Funds, as you can run into serious problems down the road if payments are earmarked for the wrong account.

2. The right tool for the job

Probably the most common type of payment that you’ll process will come in to pay all or part of an invoice or statement that you sent previously.

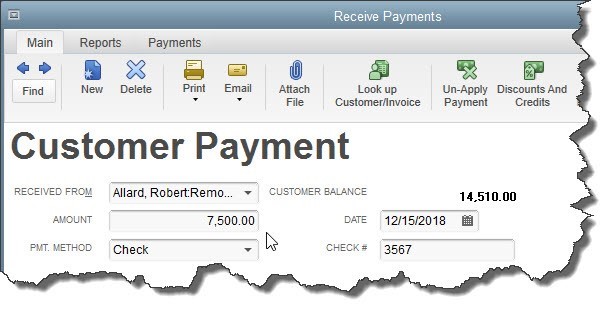

Figure 2: You’ll record payments on invoices you’ve sent in this window.

To do this, open the Customers menu and select Receive Payments. In the window that opens, click on the arrow in the field next to RECEIVED FROM to display the drop-down list, and choose the correct customer. You’ll see the outstanding balance. Enter the amount of the payment you received in the AMOUNT field and change the date if necessary. Click the arrow in the field next to PMT. METHOD, and then select the type of payment.

If you established a credit card as the default payment method in the customer record, the card number and expiration date will be filled in. If not, or if a check was submitted, enter the information requested.

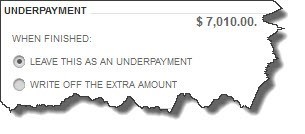

Any outstanding invoices will appear in a table. Make sure that there’s a check mark in front of the correct one(s). If the customer only made a partial payment, you’ll have to indicate how you want to handle the underpayment. Here are your options:

Figure 3: You can select how to handle partially-paid invoices here.

When you’re done, save the payment.

Instant income

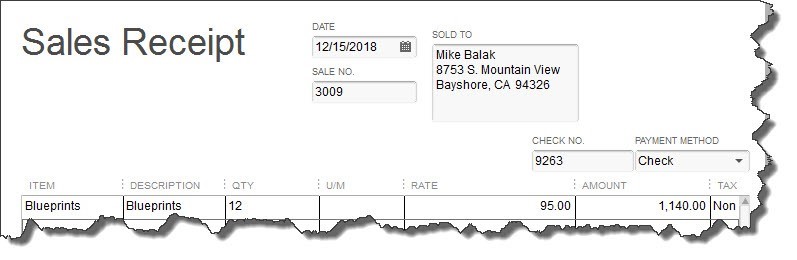

There may be times when you receive payment immediately, at the time your products or services change hands. In these cases, you’ll want to use a sales receipt. Open the Customers menu again and click Enter Sales Receipts.

Select a customer from the drop-down list or add a new one, then fill out the rest of the form like you would an invoice, selecting the items and quantities sold, and indicating the type of payment made (cash, check, credit).

Figure 4: Fill out a sales receipt when payment is received simultaneously with the sale.

Other scenarios

These are the most common methods of receiving payments from customers, and you may never have to do anything other than simple payment-recording and sales receipts.

But unusual situations may arise that leave you stumped. For example, a customer may want to make a partial, advance payment before you’ve created an invoice or at the same time you’re entering it. In a case like this, you’ll have to create a payment item so that the money you’ve just received is reflected on the invoice. Or you may get a down payment on a product or service, or even an overpayment.

Let us help you when such situations occur. It’s much easier –and more economical for you – to spend some time with us before you record a puzzling payment than to have us track it down later on. We’ll help ensure that your money makes it to the right destination. Call us today at 256-337-5200.

Register today – call 256-337-5200! Pre-registration required: classes fill up quickly. Each class is limited to eight attendees and customized to the specific needs of those attendees. SBS offers four types of classes: Accounting, Business Owners, Fundamentals, and Advanced. Attendees will receive a QuickBooks workbook and snacks. Call for more details. Call now -- classes fill up quickly.

Let us help you when such situations occur. It’s much easier –and more economical for you – to spend some time with us before you record a puzzling payment than to have us track it down later on. We’ll help ensure that your money makes it to the right destination. Call us today at 256-337-5200.

A version of this blog was previously posted here: http://qbbob.com/2-ways-to-receive-customer-payments/

As ERP consultants, we run into examples all the time where QuickBooks is not an ideal solution for manufacturing for customers using QuickBooks out...

QuickBooks CRM: 5 Important Questions to Ask CRM Vendors Are there a large number of third-party add-on applications available through an...

Accounting software is an extremely important tool for every business. For many small companies or start-ups QuickBooks is a great system. As time...