Time-Sensitive Sage 100 Updates in 2022 with Big Impacts on Your Business

Don't Miss Important Sage 100 Updates in 2022! Sage 100 users who don’t take action by the end of 2022 face potential disruption when Sage ends...

2019 Sage 100 Payroll Reports and Tax Table Updates

2019 Sage 100 Payroll Reports and Tax Table UpdatesEvery year there are important changes to Sage 100 payroll reports. You get tax table updates from Sage with an active maintenance plan. This year, US Federal changes will introduce several payroll reporting requirements. Here’s what you need to know about these requirements, and how we are updating Sage 100 Payroll to help you stay compliant.

2. Changes based on the 2020 W-4 form - Changes for Payroll version 2.20, available in December 2019 for tax year 2020, are under review. Sage is waiting for finalization of the W-4 form and Publication 15-T.

How do I find out more information? You can contact us via our Contact Form, call us at 760-618-1 with over 25 years in the accounting software industry.

Mike is also a Sage Certified Trainer and a recognized leader in the design, implementation and support of ERP systems, including Sage. Specialties: Sage 100 (formerly MAS90), Acumatica, QuickBooks Pro Advisor.

IMPORTANT NOTE: Please consult with your certified Sage 100 ERP consultant before making any changes to your Sage 100 system. If you don’t currently work with a Sage 100 consultant, contact us.

Call 760-618-1395 or email us and we will be happy to help.

Another version was posted here: Sage 100 – Payroll Upcoming Changes from Sage and Federal Government

Photo courtesy of freedigitalphotos.net by Stuart Miles

Don't Miss Important Sage 100 Updates in 2022! Sage 100 users who don’t take action by the end of 2022 face potential disruption when Sage ends...

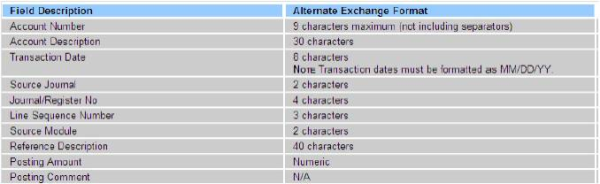

Question: Mike, we own Sage 100 ERP (formerly Sage MAS90); we also use ADP for our Payroll. How can we import the ADP Payroll information into the ...

1 min read

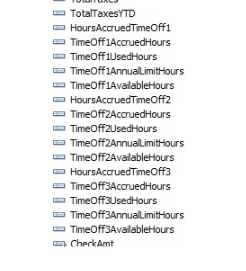

Sage 100 Tips and Tricks: Sage 100 Payroll We're Missing the Vacation, Sick and PTO Accruals on Check Forms...HELP!!! When you have employees, it's...