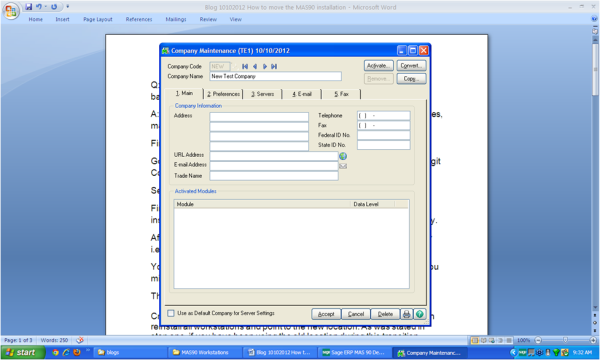

Sage 100 ERP: How to make a backup of your company data

Question: Mike, we own Sage 100 ERP (formerly Sage MAS90). How do we make a backup of our Sage 100 ERP company Data?

1 min read

Mike Renner Wed, Jan 02, 2013

Large employers, defined as those that filed 250 or more Form W‐2’s for the 2011 tax year, must report the cost of health insurance coverage on 2012 W‐2’s. Small employers (those that filed 250 or fewer W‐2’s for the 2011 tax year) must report this information on their 2013 Form W‐2’s. Employers issue Form W‐2’s in January following the tax year, so this means the first required reporting starts in January 2013 for large employers.

Written by Mike Renner, Partner WAC Consulting, Owner at Computer Accounting Services

Mike is an expert on Sage 100 ERP with over 25 years in the accounting software industry. Mike is also a Sage Certified Trainer and a recognized leader in the design, implementation and support of ERP systems, including Sage.

Sage 100 ERP (formerly Sage MAS90/200), Sage 100 Fund Accounting (formerly MIP Non Profit Software), Sage Grant Management, Sage Online Fundraising, QuickBooks Enterprise and Point of Sale VAR.

Question: Mike, we own Sage 100 ERP (formerly Sage MAS90). How do we make a backup of our Sage 100 ERP company Data?

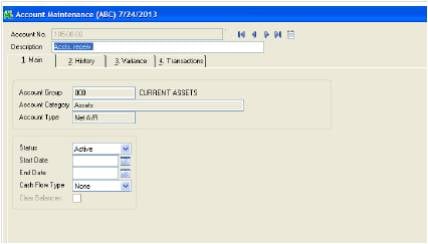

Question: We own Sage 100 ERP (formerly Sage MAS 90, MAS 200), we have some duplicate General Ledger Accounts, how do we merge these together. ...

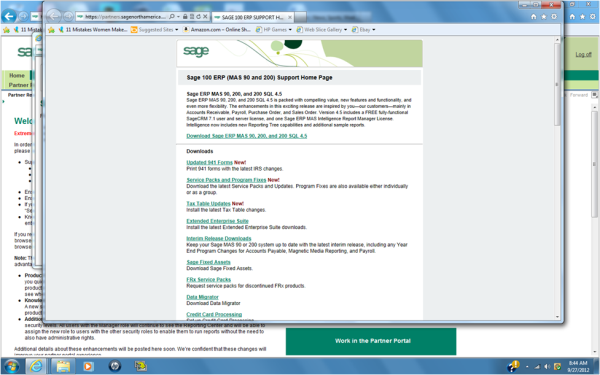

Question: Mike, we own Sage 100 ERP (formerly Sage MAS90), we process Payroll. How do we get and install the new 941 forms?