Single Family Office Cloud ERP Software: Save Time With Streamlining

Save time and streamline with single family office Cloud ERP software If you're like many single family office wealth management firms, you may...

2 min read

Erica Burles 30 Jan, 2020

A shocking number of wealth management firms trundle on with expensive, on-premise software and hardware instead of investing in new ERP software for financial services. Countless hours are spent consolidating multiple funds, often in multiple currencies, so it's almost impossible to provide the real-time insights needed for quick investment decisions.

Among the biggest challenges in shifting to a data-driven decision-making culture is the need for more data in real time. If you’re currently struggling to deliver insight and analysis easily with your current ERP software for financial services, here are the 3 advancements credited by top firms to obtaining and providing deeper financial insight in real time and on demand and that have had the biggest impact.

Usually a “fast close” means the time between the period end date and when the financials are released is as short as possible. In most cases, teams wait until the period ends to start data compiling. Now imagine what happens when you don't have to wait for a period to end to start compiling the reporting. It’s possible with financial services accounting software, in this case Sage Intacct.

Sage Intacct constantly and automatically consolidates all your data all month long. Which means that you can run your reports at any time because the databases are updated in real time, all the time. No more waiting for the period to end to consolidate all your data from hundreds of emails into dozens of spreadsheets. With Intacct, managers and executives can see key trends sooner, and ultimately act faster.

"No more waiting for the period to end to consolidate all your data from hundreds of emails into dozens of spreadsheets...you can run your reports at any time because the databases are updated in real time, all the time."

If you're like many, you suffer from barriers to ad hoc reporting because of the disconnected, disparate data sources. The time it takes to collect, input, and report on your bevy of financial and operational data probably costs weeks in some organizations depending on complexity. And worse, dozens of spreadsheets must be updated and recalculated to provide the reporting executives need, which means it's error-prone.

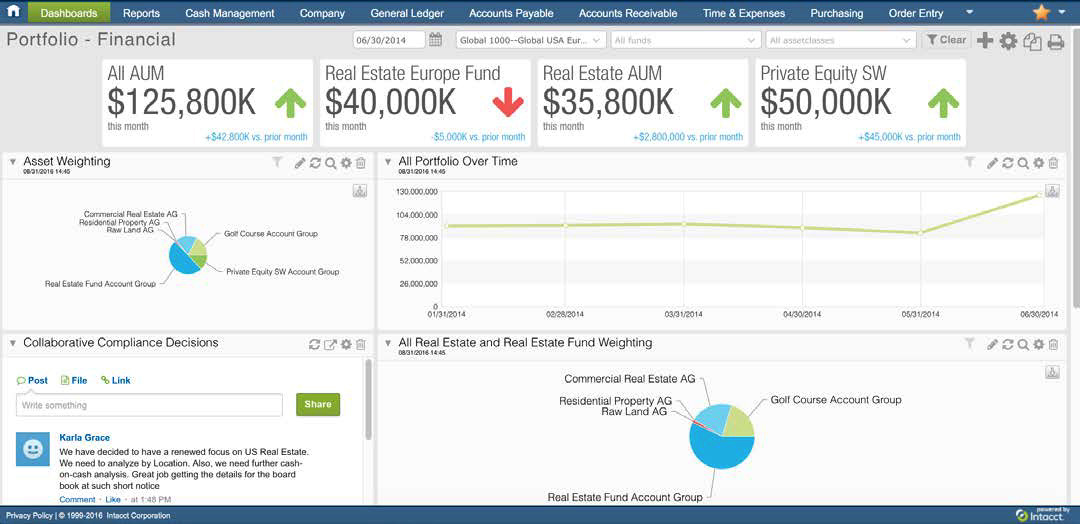

Ideally, like with Sage Intacct, you would have a live connection that is continuously collecting and consolidating data so you can create real-time reports enabled by that constant connection to the underlying data. Intacct makes it easy to build visual reports and dashboards which you can easily save as templates. With Intacct, your managers and executives can self serve their own requests.

Unfortunately, spreadsheets completely lack built-in visual cues that would prompt management to action. Your reports should be be delivering insights that drive your teams to respond, usually defined by 8-10 key performance indicators.

To enable a better understanding of cause and effect, Sage Intacct’s wealth management accounting software has built-in dashboards with drill-down capability all the way to the transaction level. Your team members or auditors can answer questions with sort, filter, and group functions. And unlike spreadsheets, trends are easy to spot in Intacct with color-coded trend indicators, dynamic graphs, and interactive charts.

Improve your wealth management firm’s performance, productivity, and growth with real-time data on demand that makes decision-making quicker and easier with the only AICPA-recommended financial services accounting software, Sage Intacct.

Contact Equation Technologies to learn how Sage Intacct can transform your wealth management accounting today.

Another version of this blog was posted on January 7, 2020 - Real-Time Reporting Accounting Software for Financial Services

Save time and streamline with single family office Cloud ERP software If you're like many single family office wealth management firms, you may...

Stay competitive and get real-time data with ERP asset management software. Growing wealth management firms are increasing their access to...

Sage Intacct Healthcare Accounting Software If you're struggling with QuickBooks and spending countless hours using manual processes for...