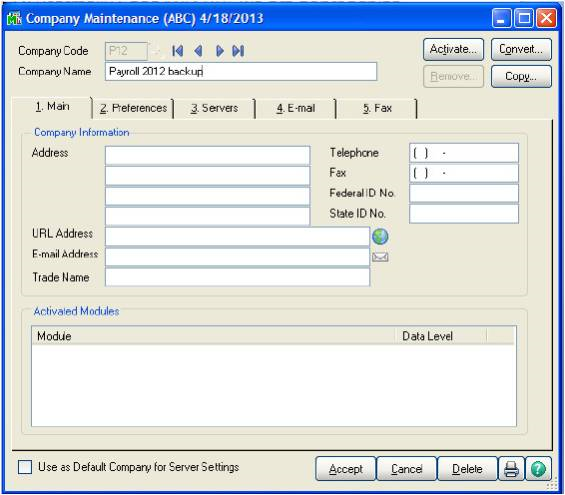

Sage 100 ERP (MAS 90): How to Perform a Payroll Backup

Question: Mike, we own Sage 100 ERP (Sage MAS90), we are approaching the end of a payroll year, why is it recommended to do a backup? What are the...

2 min read

Jennifer Christon Fri, Dec 14, 2012

All you Sage 100 ERP Payroll users out there – this is the blog to take heed too! Here are some pointers on making sure you are ready for Payroll year-end….

The 2012 Q4 IRD will be available the week of 12/17, so keep your eyes peeled for it on the Sage 100 ERP updates page in the customer portal. Give us a call if you need assistance finding that page. The IRD (Interim Release Download) will include any year end program changes for Payroll, Accounts Payable, and Electronic Reporting modules. This update is also vital for program changes for eFiling and Reporting.

Anyone who is using the Accounts Payable module and creating 1099s needs this update! There are AP 1099 form changes that will be updated in the 2012 IRD, so the IRD is not just for the Payroll users.

The 2012 Q4 Tax Table update is available on the Sage Customer Portal for anyone who still needs it for processing their last payrolls of the year.

Remember that year end processing should be done after your 12/31 checks have been entered and updated. You do not want to go through your Period End Processing for payroll until all of your Payroll transactions have been updated.

Important steps to follow:

Good luck and happy year-end!

Jenn brings to ASI a unique background in accounting and business. With not only technical and functional experience but project management skills as well, Jenn has fundamental knowledge of all the phases of an implementation project. She has worked as an end user as well as a consultant, giving her the perspective to understand system “pain points” and know how to analyze and present solutions. Her project expertise includes: Software Implementations and upgrades, Distribution / Inventory, Client Server Applications, Business Process Reviews and Optimization, as well as System Analysis and Design. She also has experience in logistical project planning as well as technical experience with Crystal Reports and SQL. Part of Jenn’s upgrade experience also includes upgrading Sage 100 Providex clients to Sage 100 SQL. To contact Jenn or find out more about what her team at ASI can do for your business visit ASISucceed

Question: Mike, we own Sage 100 ERP (Sage MAS90), we are approaching the end of a payroll year, why is it recommended to do a backup? What are the...

Question: We recently installed Sage 100 ERP version 2013. After printing Payroll check and clicking the Check/Register Update. We got a strange...