Sage 100 ERP (formerly MAS 90): How to install the IRS W2 1099 End of Year IRD updates

Question: Mike, we own Sage 100 ERP (formerly Sage MAS90), we process Payroll. How do we get and install the W2, 1099 End of Year IRD updates?

3 min read

Mike Renner Fri, Jan 27, 2017

Answer: In order to print W2 and 1099 forms, you will need the 4 part blank perforated forms for the recipients as well as the other required forms from the IRS. There is a very good knowledgebase article at Sage’s support website that is linked below that will tell you exactly what forms you need to purchase...see at the bottom of this article.

This is the time of year when our Sage 100 (formerly MAS 90 and MAS 200) customers ask this popular question about which forms to use for W2s and 1099s and printing of those forms. This blog is a simple review of the forms and the steps required, so it will not be so difficult to determine the steps each year.

As always, if you have any questions or concerns about this topic, please reach out to your Sage 100 consultant. If you don’t have one, please contact us and we’ll be happy to see if we can help - www.caserv.com or 760-618-1395.

Current versions of Sage 100 for printing W2s and 1099s use Aatrix, a service to help streamline your Federal and State reporting. This is a very convenient service…as long as you have a current Sage support/maintenance plan in place.

For W2 and W3 printing please follow the simple steps below:

Modules>Payroll>Period End>Federal eFiling and Reporting

Once the form comes up click on the W2 or W3 form and click Accept, if the current year W2/W3 report is not there, it means that you will need to do the Automatic Update on the form that comes up next to get the correct forms to load. Aatrix updates the forms on a regular basis so if there are new forms you will want to do the Automatic Update.

To complete the W2 printing you will want to follow the steps on the Aatrix form to completion. It is a very simple step by step process mostly just clicking the Next Button and printing the forms.

For 1099 and 1096 printing we have include more detailed instructions below:

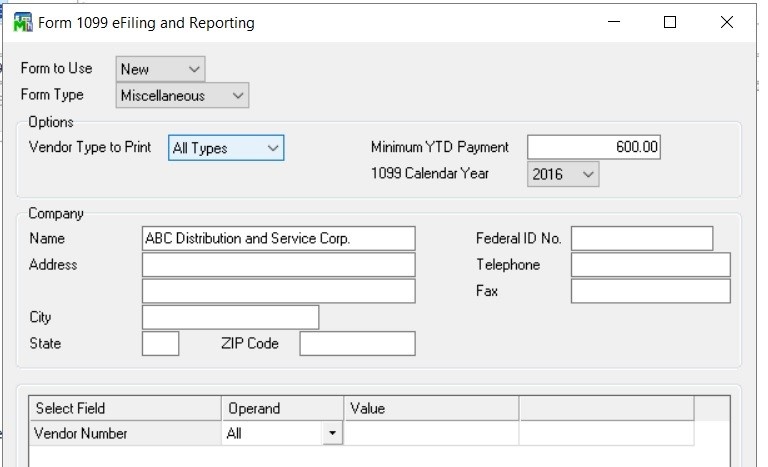

Modules>Accounts Payable>Reports>Form 1099 eFiling and Reporting

On the 1099 form set the Form type as Miscellaneous, the correct year and Minimum YTD amount to $600. Then click Accept. If there are new forms you will want to click the Automatic Update button on the next screen.

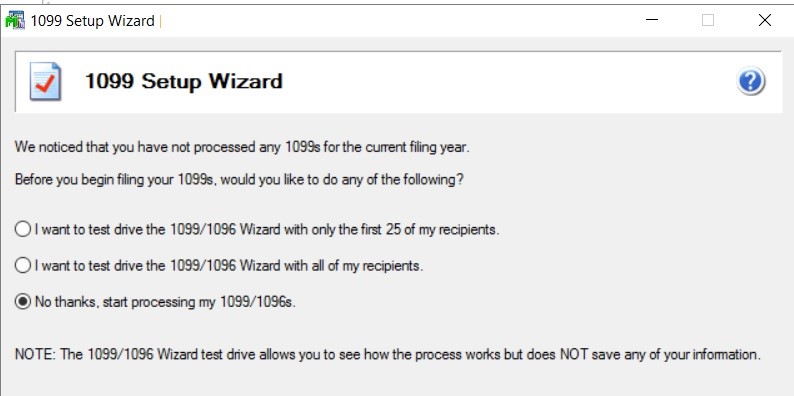

On the 1099 Setup Wizard you can choose the test drive for print the 1099’s. First time through would suggest you test drive, and do some sample prints to plain paper. Click Next and there will be a series of questions to answer in the Wizard, usually the default answers will be sufficient.

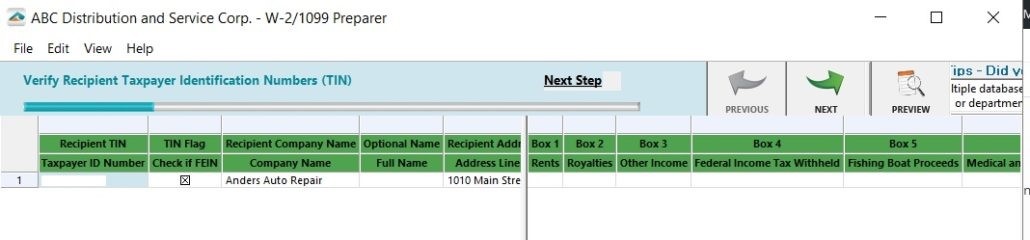

The screen will show Verify Recipient info in spreadsheet format. You will click the green next buttons, verify the information, if there are errors in the data Aatrix will error and require correction before moving forward. Things like you do no have a Tax ID number and it will be highlighted in red.

You should continue to click the green next button. If you want to enroll in Aatrix’s eFiling you can do that, click next the get past the Ads.

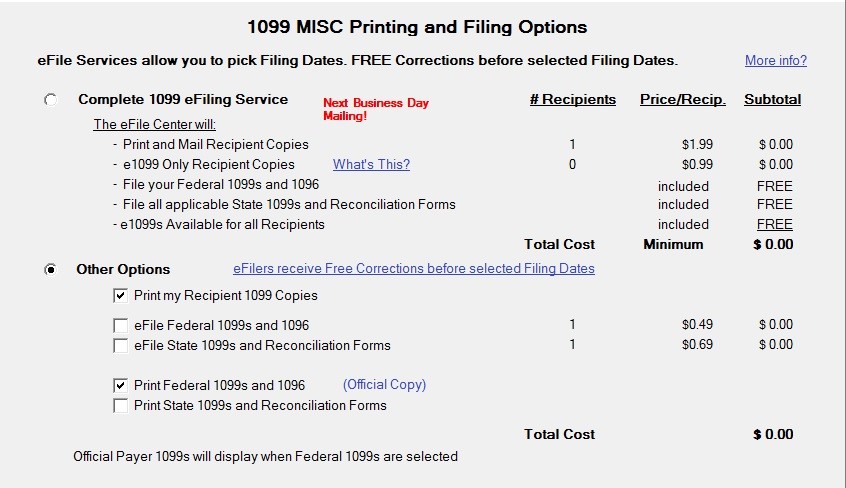

At the Print Options page select Other Options and select the print the 1099’s and 1096. Then click next four times.

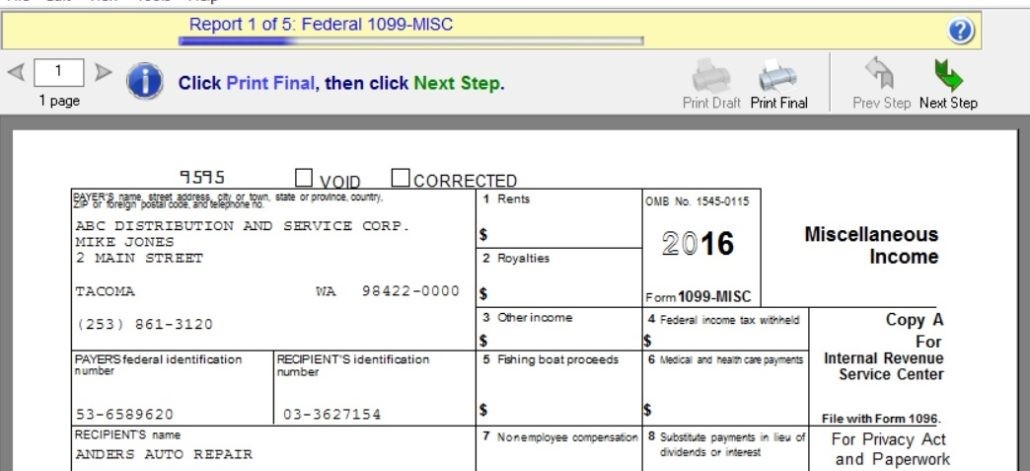

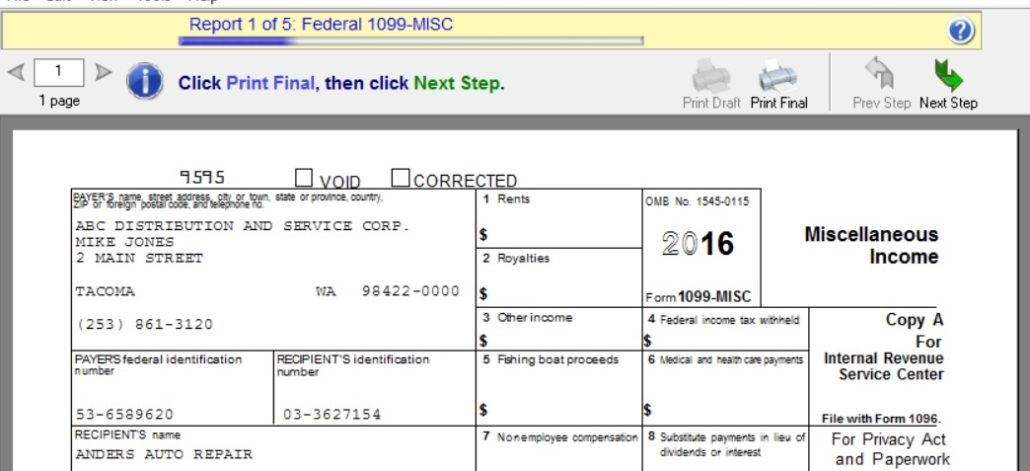

Aatrix will preview the 1099’s on the screen, you can click print final, Aatrix will instruct you with the type of paper to insert, print and then click next step. The system will repeat this process until you are done printing the 1099’s. You are done at this point.

Here's the Sage KB Article 52202

Stay tuned for more helpful Sage 100 ERP tips! If you have questions please contact us at www.caserv.com or 760-618-1395.

Please feel free to contact me if you have questions about cloud or on premise Acumatica or on premise Sage 100 ERP software Business Insights reporting or any other question about Sage 100 ERP software (MAS90/MAS200), please call 760-618-1395 or email me at info@caserv.com

Written by Mike Renner Sage 100 consultant: Partner of WAC Consulting and Owner at Computer Accounting Services, an Acumatica and Sage 100 ERP software consultant and support provider based in Indio, CA.

Mike Renner is an expert on ERP and fund accounting and supports Abila Fund Accounting, Sage 100 ERP, and Acumatica with over 25 years in the accounting software industry. Mike is also a Sage Certified Trainer and a recognized leader in the design, implementation and support of ERP systems, including Sage.

Specialties:

Sage 100 ERP (formerly Sage MAS90/200), Acumatica ERP, Abila MIP Fund Accounting, Abila Grant Management, QuickBooks.

Another version of this blog was published here: Sage 100 how to print W2’s & 1099’s and what forms are needed for printing W2’s, W3’s, 1099’s and 1096’s

Question: Mike, we own Sage 100 ERP (formerly Sage MAS90), we process Payroll. How do we get and install the W2, 1099 End of Year IRD updates?

Question: Mike, we own Sage 100 ERP (formerly MAS 90), while printing to a paperless office, the system just hangs and does not complete or respond.

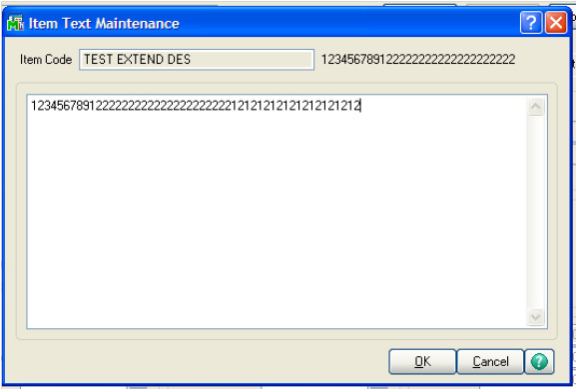

Question: Mike, we own Sage 100 ERP (formerly Sage MAS90), we have lengthy inventory extended descriptions, how can we get these to print on sales...